Transform Your Business with Mula Groups: Access Seed Funding Without Traditional Banking Barriers

Why Mula?

working to redefine Africa's finance.

600 Participants

35 Women groups

2.5M Disbursed

In rural Africa, credit costs reach 120% to 720% per year, Mula is committed to reducing these burdens.

Start saving today! True wealth is built by reducing spending and investing in your financial future

Save more by buying in bulk with Manna—Affordable Essentials Delivered to Your Door.

Enjoy a simple digital wallet that revolutionizes the way you manage your finances.

Our Products

Save & Grow

Join a Chama and Start Growing Your Savings and Financial Power with Mula.

Access Seed Capital

Get funding to expand your opportunities without the barriers of traditional banking.

Simple Digital Wallet

Gain full control over your expenses with Mula’s easy-to-use budgeting tools.

Access to Mula Plus+

Access Mula Plus+ for Emergency Financial Support and Welfare Benefits.

Access to Manna

A monthly package that has common household items at an affordable rate, helping you save thousands of shillings annually.

Buy A Bond

Can’t raise full repayment this month? Buy a bond at your chama meeting—no need to stress.

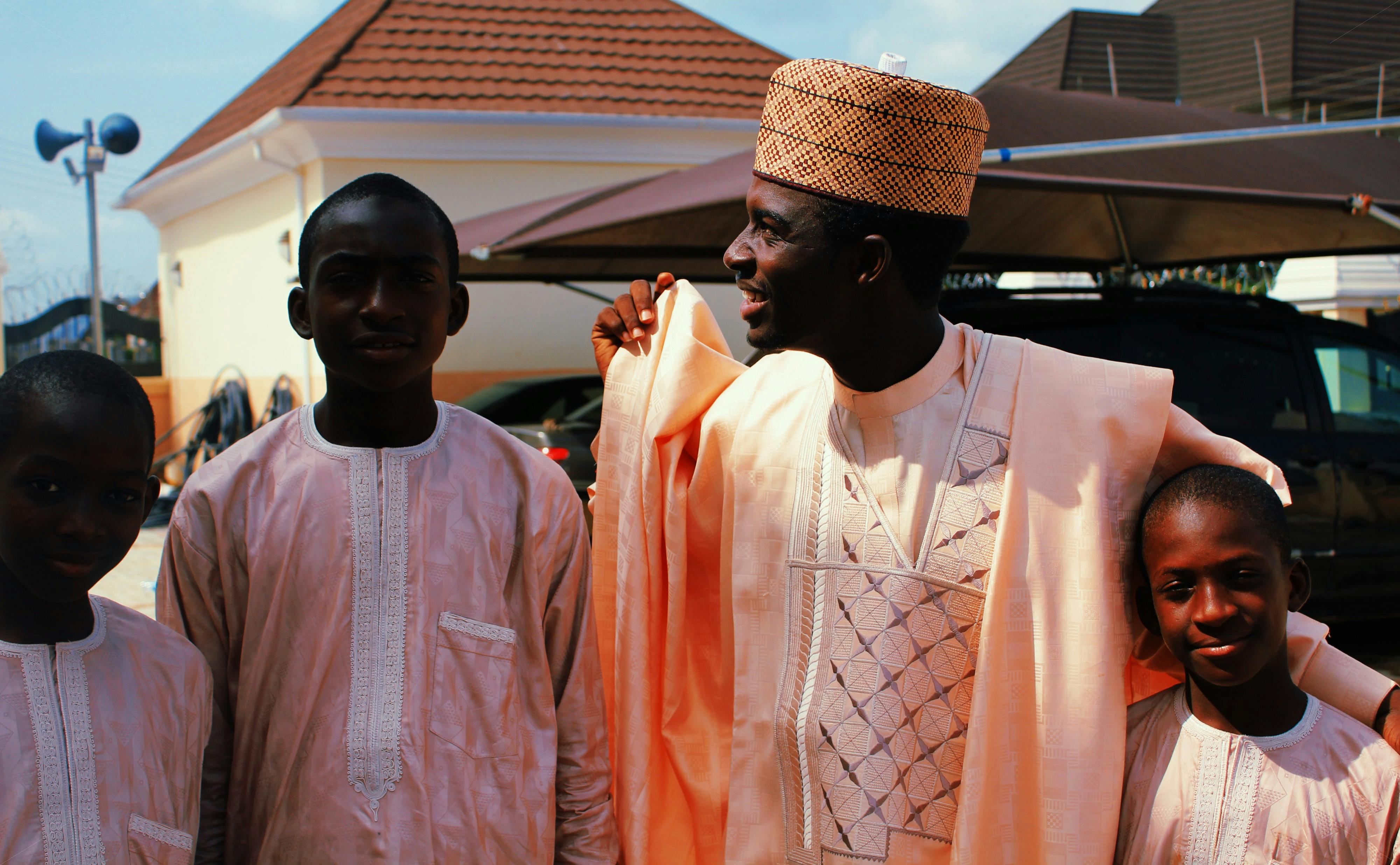

Real Impact. Real Stories

Millicent

Tem Kinyalo, Nyilima

My business has grown since I joined Mula because now I can access capital at low interest rates.

Join the Movement

We are rewriting the rules of financial empowerment and inclusion across Africa, one village at a time.